The Woodlands Sales by Villages & Subdivisions

As always, we strive to keep our friends and clients informed about the housing market in our area. Using information we gathered from the Houston Association of Realtors, we are happy to share with you the information below showing recent developments in the housing market in The Woodlands area.

If you are browsing with mobile smartphone, rotate for better experience.

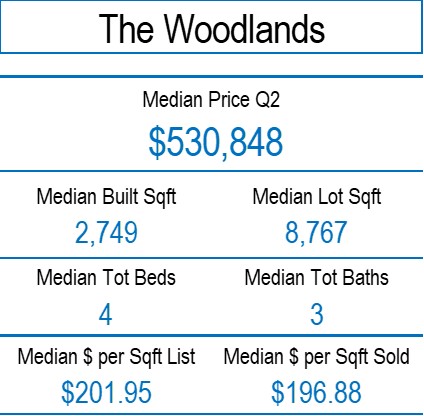

The Woodlands

2023 Q2 Summary Review of Sold Properties

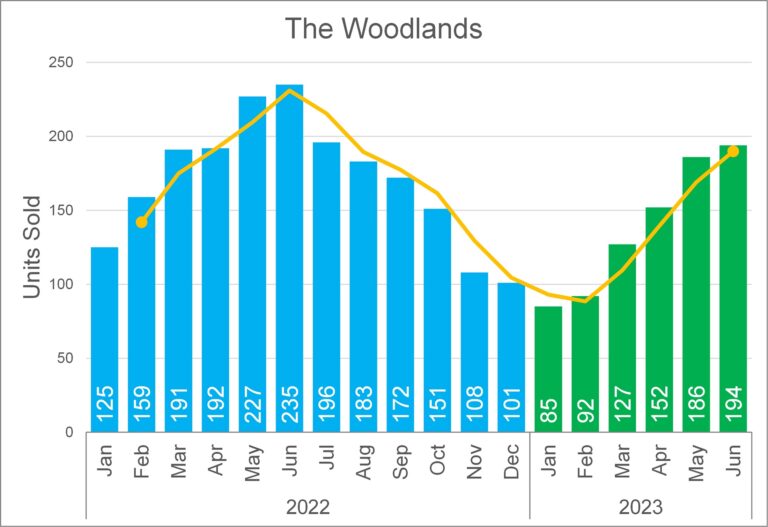

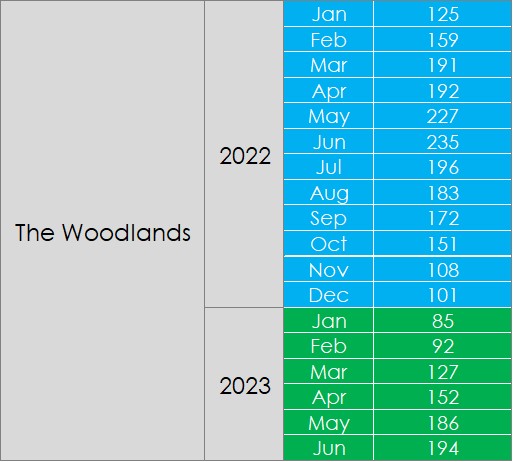

Q1 2022 to Q2 2023 Units Sold

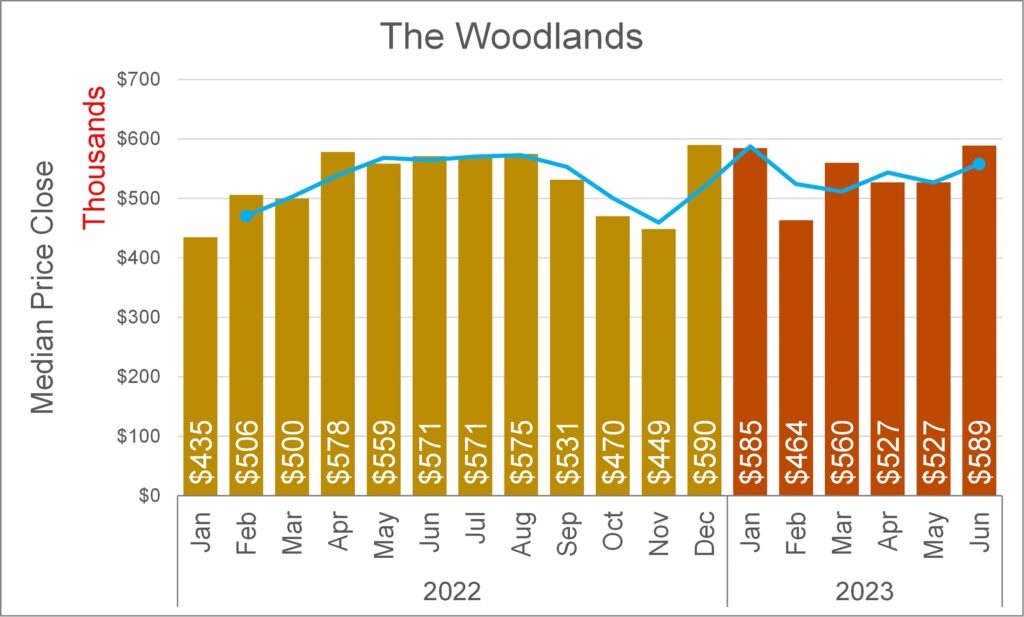

Q1 2022 to Q2 2023 Median Price Sold

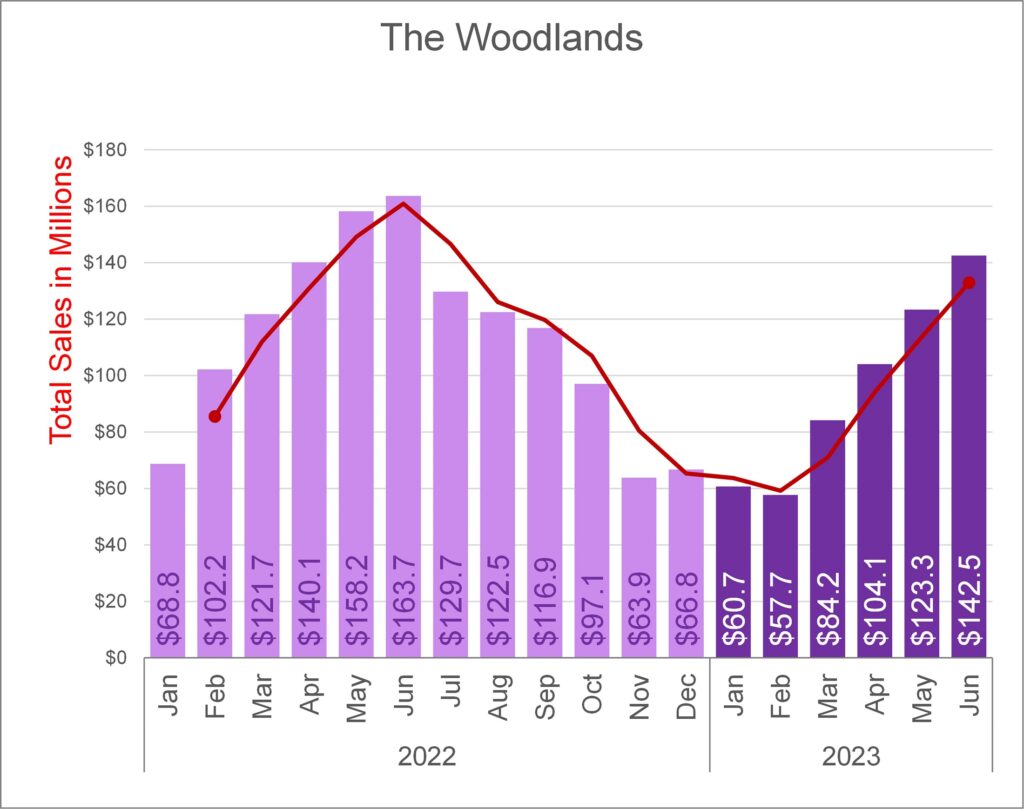

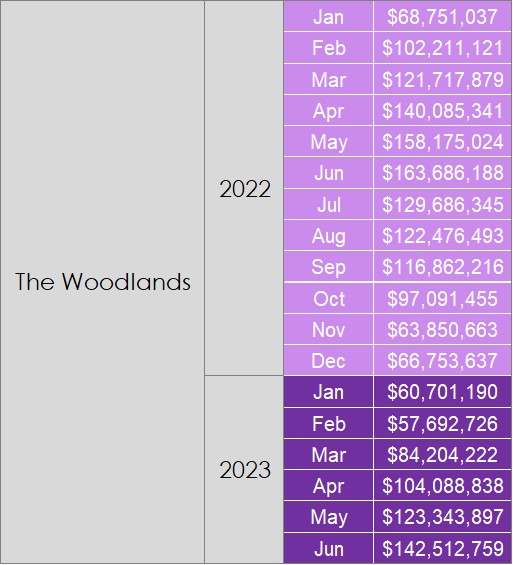

Q1 2022 to Q2 2023 Total Sales

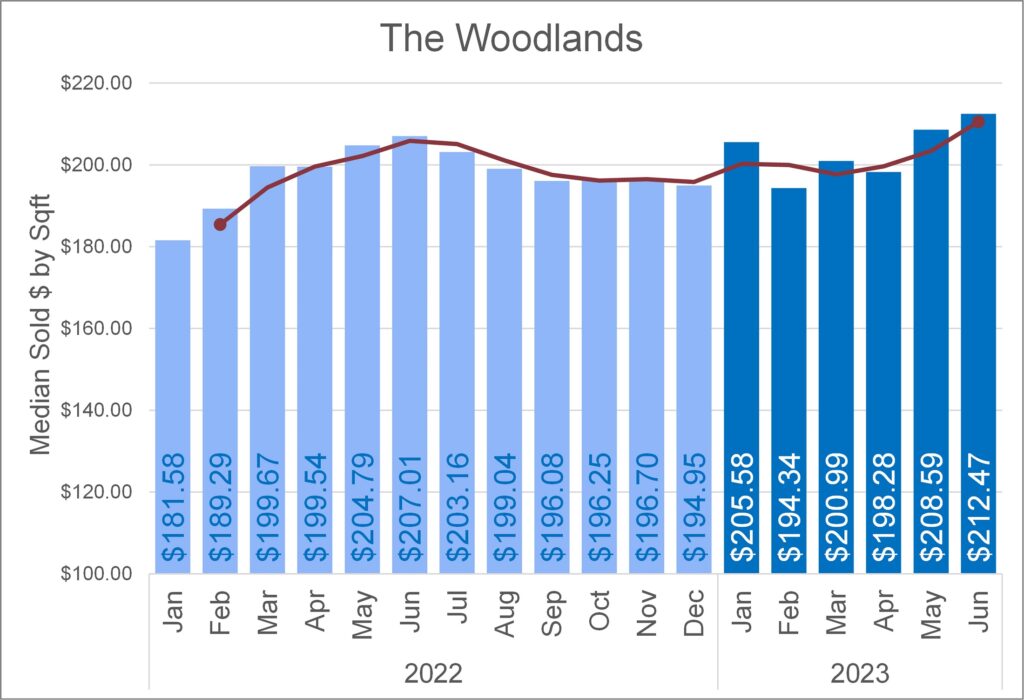

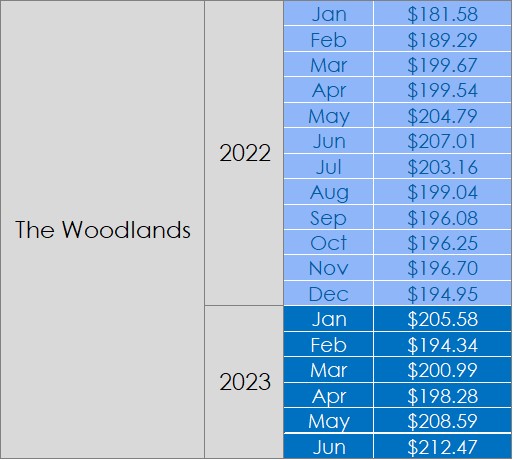

Q1 2022 to Q2 2023 $/Sqft Sold

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The Grijalva Group, LLC. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The Grijalva Group LLC. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.